Started over 370 years ago, Post Office UK bank is a commercial bank in the UK. The bank has over 11500 branches all over the UK, with 97% of them being run by retail partners, agencies and franchise basis.

The bank also has an online platform where customers can access services such as Post Office Money Personal Loan application and many more.

Apart from loans, the bank also offers other services such as savings, mortgages, insurance, credit cards, foreign currency, as well as mail services. Customers can get most of these services at their local post office branches all over the UK.

Personal Loans

A personal loan is a loan that an individual is supposed to repay through fixed monthly installments, mostly between 2 to 5 years. The borrower also pays an interest depending on the amount offered and the duration period. Personal loans can either be secured or unsecured with unsecured loans being more expensive than unsecured loans. Unsecured loans do not require collateral, but secured loans must be backed by a guarantee such as a car or a house.

Requirements to Get a Post Office Money Loan

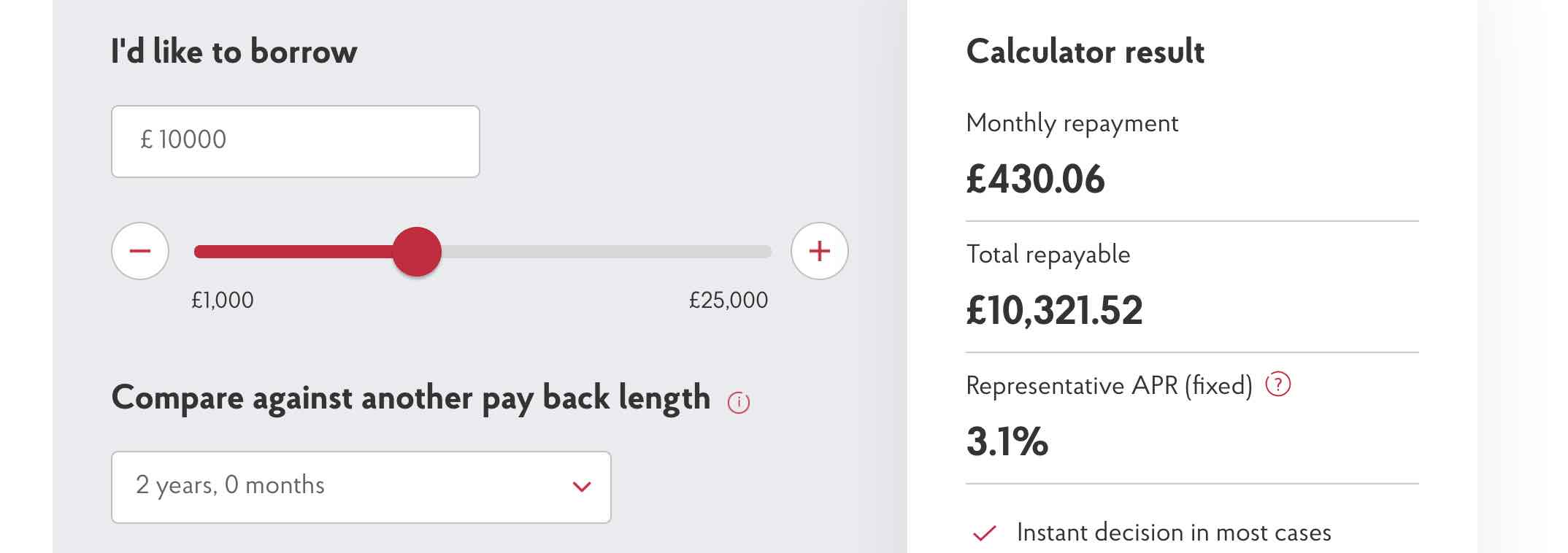

To qualify for the Post office money loan, applicants must have been a UK resident for at least three years, Should have an income of more than 12000 pounds a year and must have a UK based bank or building society account. The age limit is 21 years on the and not older than 70 years when the term ends. The bank will also conduct a credit score search and only those with an excellent credit score qualify. You can borrow £1,000-£25,000. You can pay back 1 to 7 years.

Post Office Money Personal Loan Interest Rates

The Post Office money personal loan rate depends on the amount borrowed, the loan terms and the borrower’s circumstances. Loans of £15,001 to £25,000 have a 3.4% fixed APR. For example, if a customer borrows a personal loan of £15000 from the post office to repay within 48 months, they will repay a representative APR of 3.4%. The monthly repayment will be £ 334.33 per month, translating to a total repayment of £ 16,047.74. It is essential also to note that the interest and representative rate offered on assessment sometimes differ from the rate you receive. Other factors determine the rate provided, including the amount you wish to borrow, the terms you choose, your credit rating and your credit rating. The maximum APR that you can be offered at Post Office money (UK) is 29.9%. 8.9% APR Representative on loans from £3,000 – £4,999.

Post Office Money Personal Loan Application Process

Customers who wish to apply for loan through the Post Office Money UK websites starts by filling in their details on a loan application form. The loan application process is assessed to determine whether they have met all the requirements. Some of the significant factors are their credit score and the ability to repay the given loan. The decision is instant in most cases, and the customers who qualify can get the money transferred to their bank account the following day. Repayment terms for a personal loan are from one year to seven years depending on the amount borrowed.